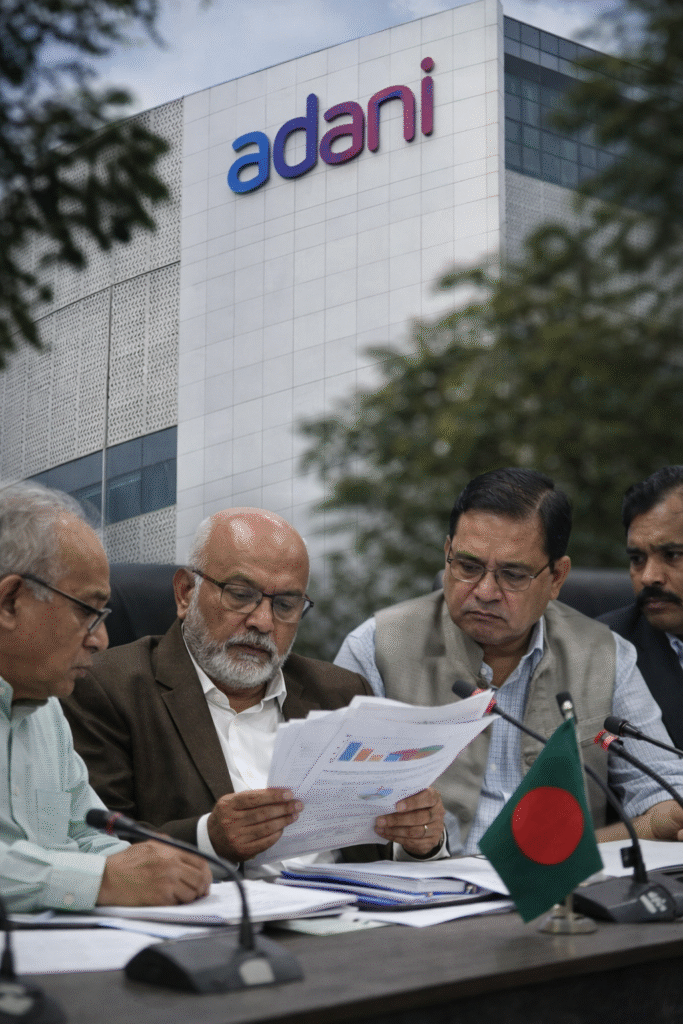

The recent allegation by a Bangladesh government panel against Adani Power has created serious buzz across South Asia. From newsrooms to chai pe charcha, everyone is talking about it. The panel claims that Adani Power overcharged Bangladesh by nearly $10 billion under a long-term electricity supply deal.

This is not just a business dispute. It involves cross-border energy trade, public money, diplomacy, and trust. Let’s break it down in easy English, without heavy jargon, so anyone can understand what’s really going on.

What Is the Controversy All About?

In January 2026, a Bangladesh government review committee submitted a report accusing Adani Power of charging around 50% more than market rates for electricity supplied from its Godda coal-fired power plant in Jharkhand, India.

According to the panel, this alleged overpricing could cost Bangladesh around $10 billion over 25 years. That’s a massive amount, bhai. The report also pointed out procedural flaws and irregularities in how the deal was signed.

👉 Main source (Reuters analysis):

https://www.reuters.com/business/energy/bangladesh-panel-says-adani-power-deal-overpriced-flags-procedural-flaws-2026-01-26/

Understanding the Adani–Bangladesh Power Deal

Let’s rewind a bit.

In 2017, Bangladesh signed a 25-year Power Purchase Agreement (PPA) with Adani Power. Under this deal:

- Electricity is generated at the Godda plant in Jharkhand

- Power is exported exclusively to Bangladesh

- The plant supplies around 10% of Bangladesh’s electricity needs

At that time, Bangladesh wanted stable power supply fast, and India was pushing for regional energy cooperation. On paper, it looked like a win-win situation.

But according to the Bangladesh panel, the pricing formula and contract terms were heavily tilted in Adani’s favour.

What Did the Bangladesh Panel Find?

The findings are serious and detailed. Here are the key points in simple terms:

1. Power Tariff Much Higher Than Market Rate

The panel estimates that Bangladesh paid 4–5 cents per kilowatt-hour extra compared to prevailing market prices.

That translates to:

- $400–500 million extra every year

- Tk 50–60 billion annually

- Nearly $10 billion over the full contract period

For a developing country, this kind of burden hurts public finances badly.

2. Procedural and Approval Issues

The panel flagged:

- Lack of competitive bidding

- Weak regulatory scrutiny

- Fast-tracked approvals without proper cost comparison

Basically, they’re saying the deal was rushed and not examined properly. In desi language — poori jaanch-padtaal nahi hui.

3. Fuel and Logistics Costs Questioned

The Godda plant runs on imported coal, not domestic coal. This increases costs due to:

- Foreign exchange payments

- High transportation charges

- Global coal price volatility

The panel claims Bangladesh ended up paying for inefficiencies it had no control over.

What Is Adani Power’s Response?

Adani Power has strongly denied the allegations.

The company says:

- The deal was approved by both governments

- Tariffs were fixed as per international norms

- Bangladesh received reliable baseload power, which has value beyond just price

Adani Group has also argued earlier that coal-based power with long-term stability cannot be compared directly with short-term spot market prices.

As of now, Adani has not accepted any wrongdoing.

Why This Matters for India

Now comes the part Indian readers should really care about.

1. India’s Image in Regional Diplomacy

India positions itself as a trusted partner in South Asia. If Bangladesh feels exploited, it can:

- Hurt India–Bangladesh relations

- Affect future cross-border infrastructure deals

- Give space to other regional players

Diplomacy is not just about politics, it’s also about perception.

2. Impact on Indian Corporates Abroad

If this issue escalates legally or politically:

- Indian companies may face tougher scrutiny overseas

- Host countries may renegotiate or cancel contracts

- Financing costs for Indian firms could rise

In simple words — ek company ka issue poore desh ke image pe padta hai.

3. Domestic Political Pressure

Opposition parties in India could raise questions like:

- Why was this deal allowed?

- Were government interests involved?

- Is public diplomacy being compromised for private profit?

So yes, this story may echo inside Parliament too.

What Bangladesh Might Do Next

The Bangladesh government now has multiple options:

- Renegotiate the tariff

- Seek international arbitration

- Cancel or restructure parts of the agreement

- Reduce dependence on imported coal-based power

Bangladesh is already shifting towards renewables and LNG, so this deal may face tough times ahead.

Expert Opinions and Global Context

Energy experts say this case highlights a larger issue long-term coal power deals signed before the renewable boom are now becoming expensive liabilities.

Globally:

- Solar and wind power costs have dropped sharply

- Coal is losing favour due to climate pressure

- Governments are rechecking old energy contracts

This Adani-Bangladesh case fits right into that global shift.

You can also read:

- Bloomberg energy insights

https://www.bloomberg.com/energy - International Energy Agency reports

https://www.iea.org

Is This the End of Cross-Border Power Trade?

Not really.

Cross-border power trade is still important for South Asia. But the rules are changing:

- More transparency

- Competitive pricing

- Shorter contracts

- Cleaner energy focus

Future deals will be tougher, more balanced, and more questioned. No more blank cheques.

Final Thoughts: A Wake-Up Call for Everyone

This allegation is not yet a court verdict, and Adani Power deserves a fair chance to defend itself. But at the same time, the findings cannot be ignored.

For Bangladesh, it’s about protecting public money.

For India, it’s about reputation and regional trust.

For companies, it’s a lesson — long-term profit without fairness can backfire.

As Indians, we should not blindly defend or blindly attack. We should ask smart questions, expect transparency, and hope the truth comes out — whatever it may be.

Because at the end of the day, energy deals are not just business, they affect millions of lives.

You may also read: Microsoft Cuts 9,000 Jobs, Then Posts an AI-Generated Image to Hire New Staff.

Sources used:

- Reuters investigation: https://www.reuters.com/business/energy/bangladesh-panel-says-adani-power-deal-overpriced-flags-procedural-flaws-2026-01-26/

- International Energy Agency

- Bloomberg Energy Analysis

Leave a Reply